17 years of helping Indian businesses

choose better software

AMLcheck

What Is AMLcheck?

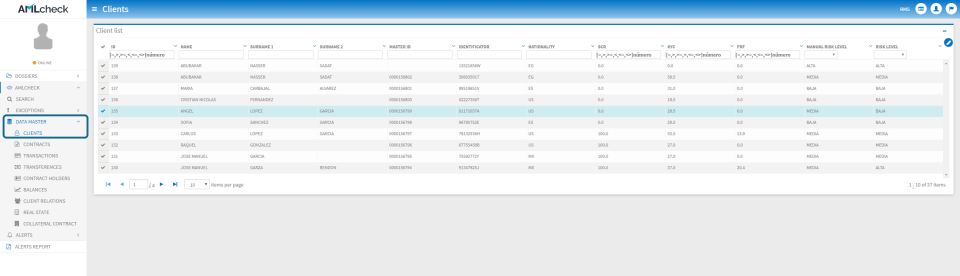

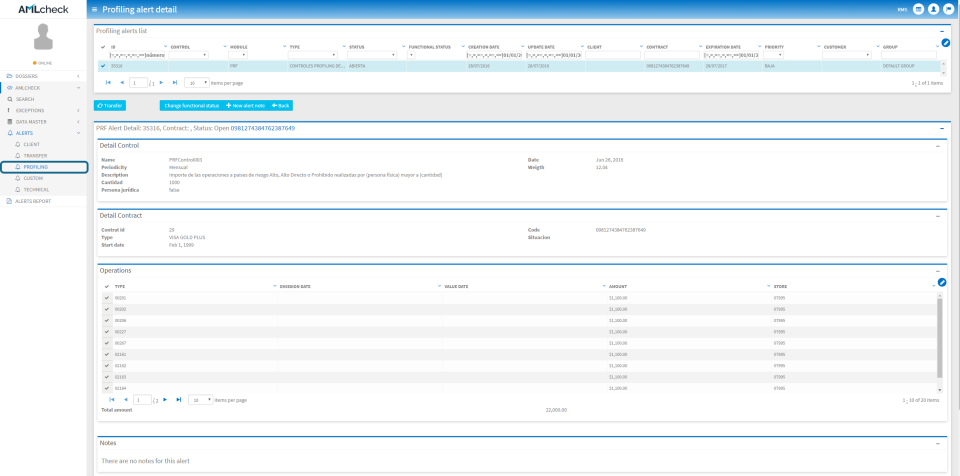

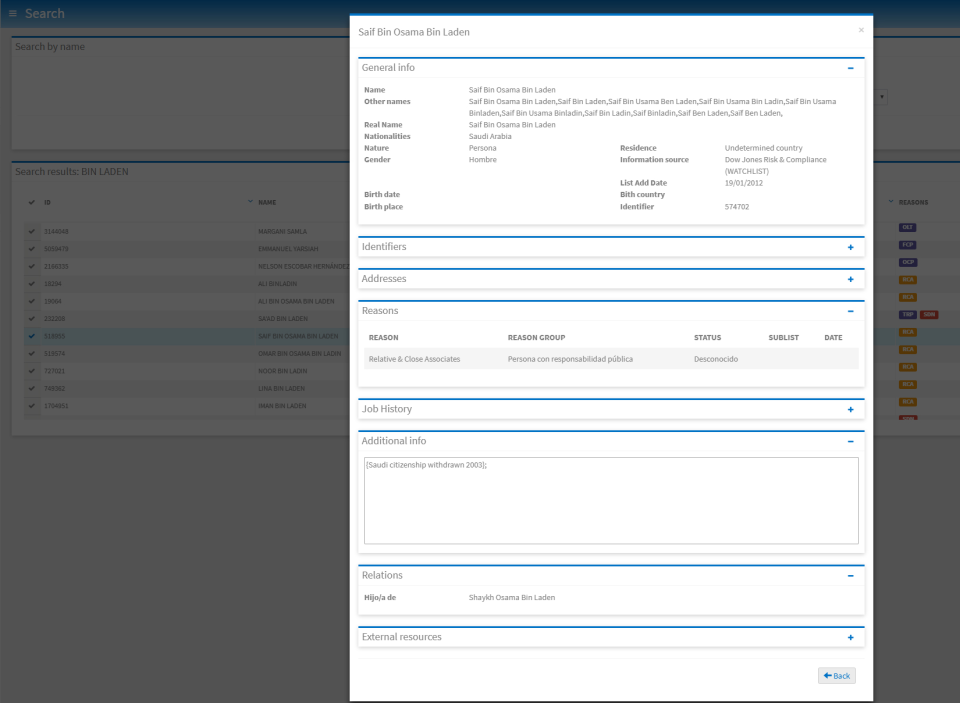

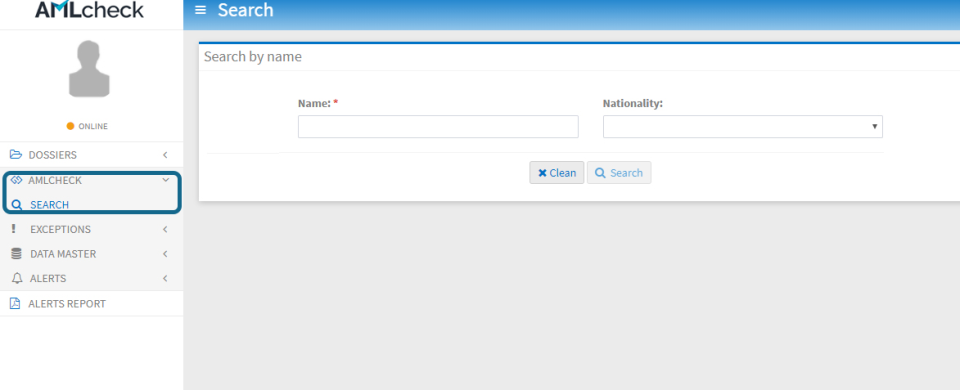

AMLcheck is an AML technological solution that enforces the legal requirements by identifying

people or assets in the onboarding process, scoring the clients profile from the database, based on

the available information, and making post-execution analysis of the transactions by defining control

scenarios to detect suspicious behaviour.

Who Uses AMLcheck?

Regulated entities, including: credit entities, insurance companies, promoters and real estate agencies, brokering companies and stockbrokers and exchange offices.

Not sure about AMLcheck?

Compare with a popular alternative

AMLcheck

AMLcheck Reviews for Indian Users

Average score

Reviews by company size (employees)

- <50

- 51-200

- 201-1,000

- >1,001

Find reviews by score

AML - DM

Pros:

I work for an investment management company and AML is hugely important to ensure the money coming is safe and not laundered. This software is by far the best and integrates well with our firm. We have tried multiple others and this is the best in regards to interface and tracking of clients.

Cons:

Costly but well worth it. I recommend getting one license and sharing it across different users if possible.

AMLcheck es el software AML más completo del mercado

Pros:

Tras varios años en el mercado, AMLcheck se ha consolidado como uno de los software para la Prevención del Blanqueo de Capitales y Financiación del Terrorismo más avanzados del mercado. Permite el chequeo de bases de datos con listas de sancionados, de forma puntual o periódica. Además, con AMLcheck, el sujeto obligado puede establecer perfiles de riesgo de cada cliente y, en el caso de entidades financieras, instaurar reglas de control que le permitan detectar operaciones sospechosas. En la última versión, han evolucionado el dashboard para hacerlo más visual, intuitivo y con mayor peso del reporting. Además, han mejorado el algoritmo para afinar más el proceso de screening y reducir el porcentaje de falsos positivos. De esta manera, el departamento de PBCFT es más eficiente.

Cons:

AMLcheck está diseñado para grandes sujetos obligados, con un volumen de clientes y una necesidad de chequeo importante para obtener el máximo partido de la plataforma.